Book: Narratives and Numbers

Author: Ashwath Damodaran

Key takeaways: An exceptional book, and I wish I had read it before.

PART I : NUMBERS

Key Aspects of Data Management:

To use numbers well in decision-making, one needs to manage data and the key aspects in collecting and managing data is as below –

- Collection: Need to think of our biases and judgement involved in-

- Amount of data one needs to collect

- The time-period one needs to look at when collecting this data

- Making Sense of the Data

- if the dataset is large enough, one needs to use basic statistical tools to make sense of the data

- Damodaran doesn’t talk about this, but more often than not, in investing, datasets are not large enough, and people use heuristics/rules of thumb to arrive at conclusions (this is why understanding of behavioral finance comes into play).

- Presenting Data

Precise vs. Accuracy: aim for accuracy first.

PART II : NARRATIVES

When people are involved in a story, they are willing to accept arguments uncritically (dropping their guard). This is where, one needs to keep remembering that stories need to be supported by numbers.

3Ps:

Is the narrative-

- Possible–this could happen, but what “this” is, is hard to envision

- valuation response: this has to be valued as an option

- Plausible–this could happen, and here’s what “this” looks like, but isn’t happening yet

- valuation response: needs to be shown as expected growth, or expected decline

- Probable–this is happening, the extent of “this” could remain a question

- valuation response: base-year estimates need to come down (question may remain as to how much)

Managerial Imperative:

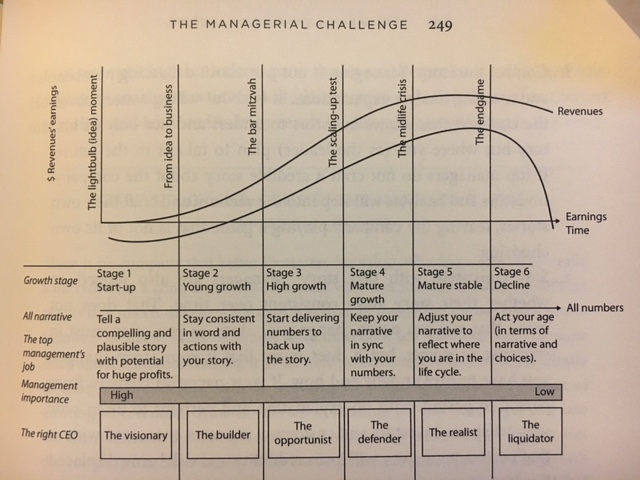

The following is an exceptional chart, and I am embarrassed to screenshot it like this. Please please go and buy the book. There are many more nuggets like this that you could benefit for that I haven’t highlighted here.